In the UAE, businesses with an annual turnover of Taxable Supplies of AED 375,000 or more must register for VAT Certificate in UAE. Once registered, companies must charge VAT on taxable goods and services they provide to their customers and submit regular VAT returns to the FTA and pay the tax due .The VAT certificate in UAE serves as proof of a business’s compliance with VAT Certificate in UAE Requirements in UAE and its relative laws and regulations in the UAE.

VAT Certificate in UAE

VAT Certificate in UAE is a crucial document for businesses engaged in taxable activities. Issued by the Federal Tax Authority (FTA), this certificate validates a company’s registration for Value Added Tax ( VAT Certificate in UAE ). It serves as proof that the business is compliant with VAT regulations and authorized to collect and remit taxes. Displaying the VAT Certificate in UAE is mandatory, enhancing transparency in commercial transactions. Timely application and adherence to regulatory requirements are essential to obtain and maintain this VAT certificate in UAE, avoiding penalties.

The VAT certificate in UAE contains the following important information:

- Name, registered address and telephone number of VAT registrant

- TRN number

- Effective registration date

- First VAT return period and VAT return due date

- Start and end dates of tax periods

How to Obtain a VAT Registration Certificate through EmaraTax?

Since EmaraTax is the UAE’s new platform to handle all the Tax procedures digitally, you can find all your registered tax certificates in the EmaraTax. For FTA account users, EmaraTax migrates your Tax certificates from e-services once you migrate your account to the EmaraTax.

For new taxpayers, log in to the EmaraTax and register for VAT Certificate in UAE by following this video.

Steps to download VAT Registration certificate for previous taxpayers

- Login to the EmaraTax Platform using Emirates ID UAE Pass or your taxpayer account.

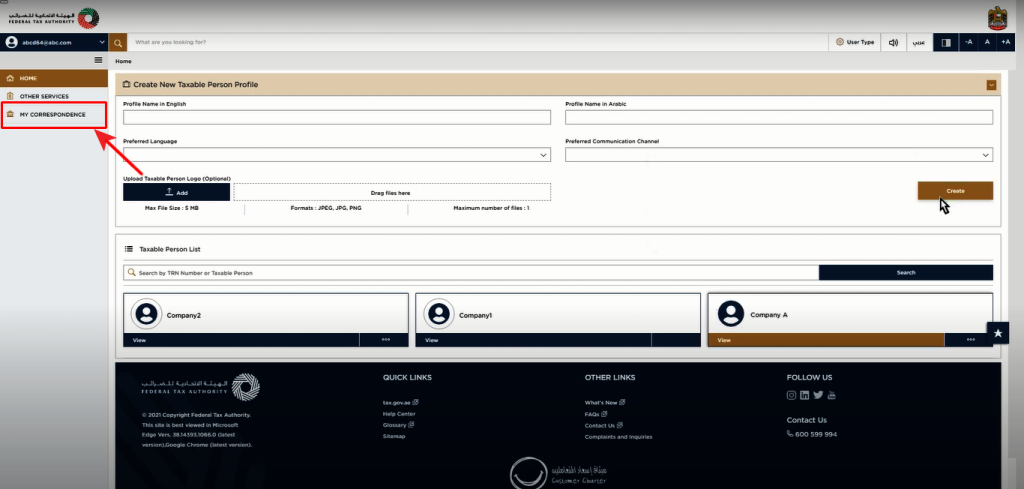

- In the Dashboard, the VAT registration certificate can be found in the “My Correspondences section of your Taxable Person account.

- Click the certificate and download it as Pdf.

Note: If you are an old user and your tax registration VAT Certificate in UAE was not available as a pdf document in your dashboard in the old account, then you will not be able to find it in your EmaraTax dashboard.

In such a case, to receive an updated registration certificate, you must submit a VAT registration amendment application to the FTA via EmaraTax with your updated information (for example, trade license, Emirates ID, Contact details, etc.). Your registration Certificate will be provided once the FTA approves your application.

Benefits of Hiring a Tax Agent in UAE

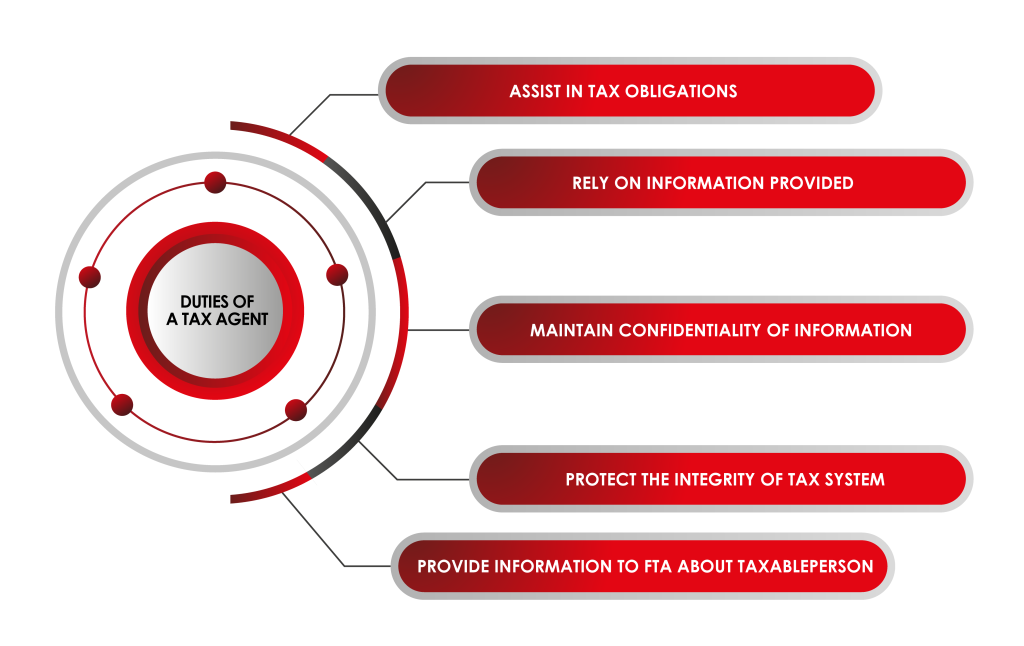

A tax agent can handle all the tax affairs of a company, whilst the business owner and key management employees can focus on other important duties. The following are the core benefits of hiring a tax agent in the UAE:

- Assists in Tax Preparations, Assessments & Representations

- Helps You Save Money and Time

- Assists in Tax Registration, Implementation, and Compliance

- Assists You in Filing Your Returns Timely & Accurately

- Acts as a Long-Term Advisor

Criteria for registering for VAT Certificate in UAE

It is mandatory for businesses to register for VAT Certificate in UAE in the following two cases:

- If the taxable supplies and imports of a UAE-based business exceed AED 375,000 per annum

- If a non UAE-based business makes taxable supplies in the UAE, regardless of its value, and there is no other person obligated to pay the due tax on these supplies in the UAE.

How is VAT Certificate in UAE collected?

VAT-registered businesses collect the amount on behalf of the government; consumers bear the VAT in the form of a 5 per cent increase in the cost of taxable goods and services they purchase in the UAE.

UAE imposes VAT on tax-registered businesses at a rate of 5 per cent on a taxable supply of goods or services at each step of the supply chain.

Tourists in the UAE also pay VAT at the point of sale.

VAT-registered businesses generally:

- must charge VAT on taxable goods or services they supply

- may reclaim any VAT they have paid on business-related goods or services

- keep a range of business records which will allow the government to check that they have got things right.

VAT-registered businesses must report the amount of VAT they have charged and the amount of VAT Certificate in UAE they have paid to the government on a regular basis. It will be a formal submission and reporting will be done online.

If they have charged more VAT than they have paid, they have to pay the difference to the government. If they have paid more VAT than they have charged, they can reclaim the difference.

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer.

How does VAT Certificate in UAE work?

The below example explain how the VAT system in the UAE works:

A manufacturer who produces a mobile phone and sells it to a wholesaler. Then, the wholesaler adds up the profit and sells the same to a retailer. Finally, the retailer increases the selling price to add the profit and sells it to the end consumer. It is to be noted that FTA charges a VAT rate of 5% on selling goods and services in the UAE.

Types of supplies under VAT Certificate in UAE Law

There are different types of supplies under VAT in UAE. The VAT rates are decided based on the nature of the goods or services.

- Standard-rated supplies: A 5% VAT rate will be applied to these goods and services.

- Zero-rated supplies: These supplies attract 0% VAT. However, taxpayers can claim relevant input tax. These supplies include a few education services, healthcare supplies, goods and services exported outside the GCC, precious metals such as gold and silver, and international transportation etc.

- Exempt supplies: These supplies are exempted under UAE VAT law, and businesses neither charge VAT nor claim input tax. You can not recover the input tax when selling or providing exempt goods or services. Exempt supplies include residential properties, undeveloped lands, public transport services, life insurance and certain financial services.

- Deemed supplies: These are the supplies that do not fall under the definition of supply; however, businesses must charge VAT. Deemed supplies in UAE include

- Business assets sold without any consideration

- Transfer of business assets from UAE to other GCC Implementing States or vice versa, and

- Goods utilised for the non-business purpose on which input tax is claimed, etc.

- Out-of-scope supplies: The FTA kept these supplies out of the ambit of VAT Certificate in UAE law.

Who shall register under UAE VAT?

The businesses whose total value of taxable supplies and imports in a year exceeds AED 375,000 must mandatorily obtain VAT registration.

What is a VAT invoice?

In the UAE, every VAT-registered seller must issue a tax invoice when selling taxable goods or services.

What is the VAT refund in UAE?

All the registered business are required to file a VAT return furnishing the details of sales, purchases output VAT and input VAT paid during the tax period. Here, the output VAT is the amount which is collected on sales and Input VAT is the amount which is paid to the supplier towards purchases / expenses. The eligible input VAT amount will be allowed to be adjusted with the output VAT amount. After adjusting the output VAT and Input VAT, the result will lead to one of the following situations.

VAT Payable: If output VAT amount is higher than the Input VAT, the balance will be VAT payable which needs to be paid to FTA.

VAT Refundable: If output VAT is lesser than the input VAT amount, the excess balance will be VAT refundable.

How to apply for a VAT refund in the UAE?

To get a VAT refund in UAE, you need to

- Request a Tax-Free purchase from the shopkeeper, who will then initiate the refund procedure for you.

- Validate your purchase at the airport or port before your departure and collect your VAT refund.

- Log in to the FTA’s e-Services portal, go to the VAT tab, then the VAT Refunds tab, and access the form by clicking VAT refund request. Complete the form and submit it.

- Ensure that your purchases are from retailers that are participants in the “Tax Refund for Tourists Scheme”.

- Have the intention of leaving the UAE within ninety (90) days from the day of purchase, along with the products that were bought.

- Goods purchased must not be excluded from the FTA’s Refund Scheme.

AHG as registered Tax agents in Dubai provides creative tax consulting services

to a broad range of individuals and businesses. Our strong technical understanding of the tax laws is backed by a solid understanding of your business dynamics,

with more than 30+ years of Practical Experiences, Dealing thousands of times

with Tax Inspectors & our Multilingual team we can give you the best tax advice.