Corporate TAX in UAE

What is Corporate Tax?

Corporate Tax in UAE refers to the amount charged by the government on a company’s profits or net income. It is an essential source of revenue for the government. It is also known as corporation tax.

Corporation tax is calculated as per the specific norms of a country. Firms’ taxable incomes comprise profits from the sale of goods or services, commissions, interests, capital gains, and rents. To obtain the applicable taxable income, allowed deductions and exemptions are deducted from the profits.

Corporate Tax in UAE Calculation

Now, let us go through the basic steps involved in the calculation of the corporate tax:

- First, find the adjusted gross income and the allowed deductions to compute the taxable income.

- Evaluate the corporation’s taxable income using this formula: Taxable income = Adjusted Gross Income – All Applicable Deductions.

- Multiply the corporation tax percentage with the taxable income to determine the corporation tax liability: Corporate Tax=Taxable Income × Corporate Tax Rate.

Registration of Corporate Tax in UAE

Providing the best corporate tax services, AHG assures a professional and timely corporate tax registration in UAE to comply with the new UAE CT regime. Getting to know about corporate tax law and its registration procedures is vital for any UAE business. So, here is the guide.

As per the FTA’s Federal Decree Law 47, The corporate tax regime demands every taxable person, which includes a Free Zone Person, requires to register for Corporate Tax in UAE and get a Registration Number. The Federal Tax Authority also requested that even the Exempted Persons should register for Corporate Tax.

Taxable Persons must file Corporate Tax returns for a Tax Period within 9 months from the end of a specific period. This deadline is normally applied in the payment of all the Corporate Taxes due in terms of the Tax Period the return is filed.

In the cases excluded as declared by the Minister, a Taxable Person must register for the Corporate Tax in UAE with the Federal Tax Authority in a specific format, within a timeline declared by the authority.

The Authority requires the Taxable Person or the Independent Partnership, to register for Corporate Tax and obtain the Tax Registration Number. The Tax Authority should have a unique judgment for the Registration of Corporate Tax in UAE from the day an individual becomes a Taxable Person.

Once the registration of corporate tax is completed, the tax persons have to pay a standard rate of Corporate Tax in UAE of 9% on taxable income above AED375,000, while taxable income up to AED375,000 is charged 0%.

Steps To Register For Corporate Tax in UAE:

To register for Corporate Tax in UAE on EmaraTax, determine the legal structure of your business (LLC, sole proprietorship, etc.), choose a trading name, obtain the necessary licenses and approvals, and then apply for a Tax Registration Number. Finally, file and pay your taxes in accordance with the regulations set forth by the UAE government.

Here is the step-by-step process to register for Corporate Tax on EmaraTax:

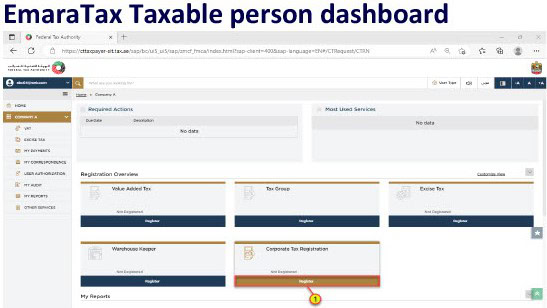

1. Log in to EmaraTax using the credentials or the UAE PASS. On successful login, you will be directed to the EmaraTax user dashboard. The Taxable Person list screen appears after a successful login to the dashboard. If there are no Taxable Persons associated with your user profile, this list will be empty, and you will need to add a Taxable Person. Click “create” and add the new taxable person.

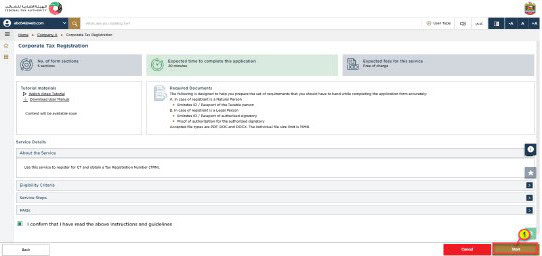

- In the dashboard, click ‘Register’ under the Corporate Tax in UAE tile to start the registration application. Moving forward, the screen displays the guidelines and instructions. Read these instructions for registration and click the checkbox to confirm.

- Click ‘Start’ to begin the Registration application for Corporate Tax

Note: The application is separated into many brief sections that cover different components of the registration of Corporate Tax in UAE process. The progress bar shows how many parts are needed to finish the application.

To go from one area to the next, all necessary fields in the current section must be filled out. The fields that are optional are labeled as such next to the field name. You must ensure to submit all the required documents for corporate tax registration. This would assist to avoid the application being rejected or resubmitted later.

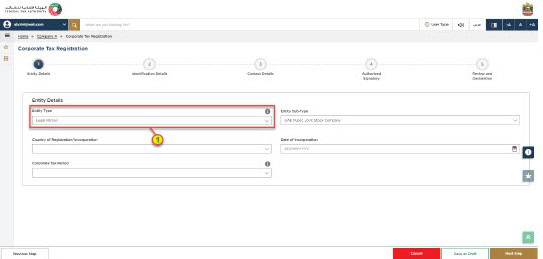

- Select the Entity Type of the business from the list in the entity details section. You may note that the input fields differ according to the entity chosen. Currently, the registration is available for the below entity and sub-types:

- Legal Person – UAE Public Joint Stock Company

- Legal Person – UAE Private Company (incl. an Establishment)

- You may click ‘Save as Draft’ to save the application if you want to continue filling out the application later.

- Once you complete the mandatory fields, click ‘Next Step’ to save and proceed to the ‘Identification Details’ section

- Based on the selected Entity type, provide the main trade license details in the Identification Details section

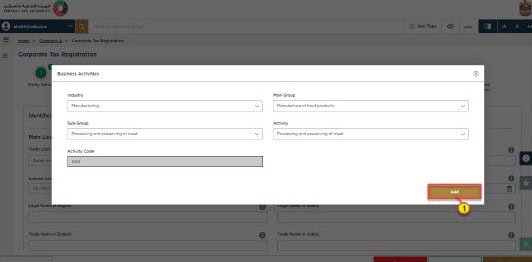

- Click on ‘Add Business Activities’ to add all the activity details related to the trade license

- Add the mandatory business activity details and click Add button. Once you ensure the relevant and required details are added, an activation code will be displayed on the screen

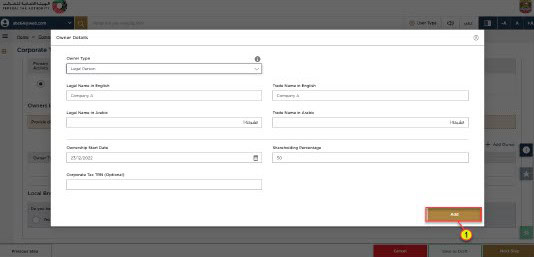

- Click the ‘Add Owners’ button to enter the owners who have ownership of at least 25% or more in the entity registered

- Enter the relevant details of the owner and click the ‘Add’ button

- If the business has one or more branches select ‘Yes’, and add the branch details. For each branch, provide the trade license details, related business activities, and owner’s list

You may note that the registration will be in the name of the Head Office, meeting the necessary criteria. Although operations are performed at the branch level also, only one registration is required.

- Once you complete filling in the mandatory fields, click ‘Next Step’ to save and proceed to the ‘Contact Details‘ section

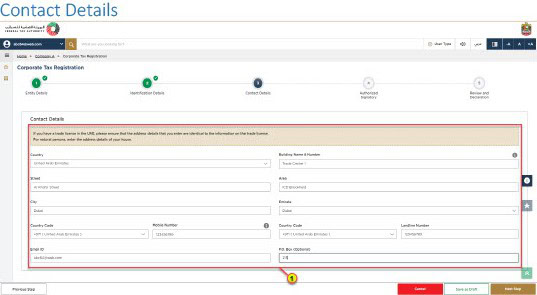

- Enter the details of the registered address of the business

Note: Do Not add other company or person addresses, your accountant’s address for example. In case if you have more than one address, provide the details of the location where most activities are held.

If it is a foreign business applying to register for Corporate Tax, appoint a tax agent in the UAE, and provide the necessary details.

- On providing the necessary details, click ‘Next Step’ to save and proceed to the ‘Authorized Signatory’ section

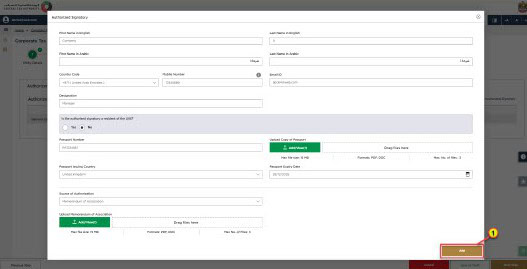

- Click the ‘Add Authorized Signatory’ button to provide the relevant details

- On entering the details for Authorized Signatory, click ‘Add’

In the case of legal persons, evidence of authorization may include a Power of Attorney or Memorandum of Association. If necessary, you can add one or more Authorized Signatories.

- On completion, click ‘Next Step’ to save and proceed to the ‘Review and Declaration’ section. This section highlights the relevant details entered throughout the application. Hence you need to review and submit the application formally.

- Once the application is reviewed carefully, mark the checkbox to declare the accuracy of the information provided.

- Click the ‘Submit’ button to submit the application for Corporate Tax Registration

A Reference Number is generated for your submitted application when it is successfully submitted. Keep this reference number handy for future correspondence with FTA

Top 6 facts you should know about corporate tax law in UAE:

- All businesses in Dubai are required to register for corporate tax.

- All companies are required to perform accounting & bookkeeping in with compliance to the Federal Tax Authority (FTA) rules.

- If your business is exempt from corporate tax, the burden of proof falls on the business.

- All businesses have to file tax returns, including companies that are eligible for exempt from corporate tax.

- The corporate regulations apply to all companies registered in free zones across UAE.

- Social media influencers and freelancers could be subject to CT.

Why was corporate tax introduced in the UAE?

Taxes on business profits were implemented in the UAE for a number of significant reasons. They include:

- To enhance the nation’s standing as a significant hub for commerce and investment.

- To accelerate the transformation and developmental programmes in order to achieve strategic goals

- To address global standards for tax transparency.

- To eliminate bad tax practises from the system.

- To increase its revenue from non-oil sources.

AHG, Top Audit and Chartered Accountants firm in UAE. Corporate Tax is to be withheld from State Sourced Income of UAE businesses in accordance with Article 45 of this Decree-Law.