Content creators refers to those who preform the process of generating and publishing digital material, such as articles, videos, images, podcasts, and other forms of media, for a specific target audience. The goal of content creation is to engage, inform, educate, or entertain the audience, and it is often a key component of marketing and branding strategies.

Effective content creation involves identifying the needs and interests of the target audience, creating content that is valuable and relevant to them, and delivering it through the appropriate channels, such as social media, blogs, or email newsletters. A Content creator may use a variety of tools and techniques to create high-quality content, including research, writing, editing, graphic design, audio and video production, and search engine optimization (SEO)

Definition of Content Creators Taxations

In most countries, content creators is required to pay taxations on any income they earn from their content creation activities. This includes income earned from advertising revenue, sponsorships, product endorsements, and other sources.

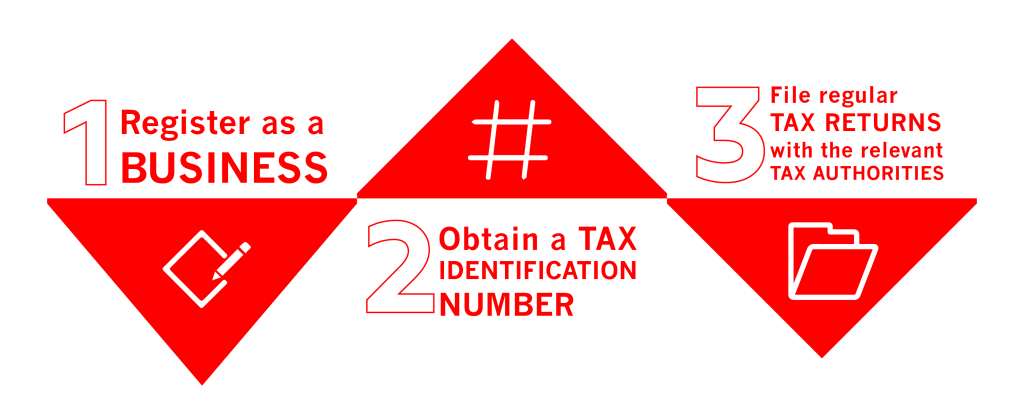

The specific taxations laws and regulations regarding content creation income can vary depending on the country and jurisdiction in which the content creator resides. In some cases, A content creator may need to register as a business, obtain a tax identification number, and file regular tax returns with the relevant tax authorities.

We’re going to demonstrate the rules and instructions to

Steps for Tax registration as a content Creator

Who are the workers that these taxations apply to?

A creator of video or audio content on YouTube who earns revenue based on views, interactions, and other conditions.

It is the creator of regular written or visual blogs that generate revenue from it.

It is a person who inspires or directs the actions of others, and there are some influencers who use this influence to generate interest in a specific thing such as a consumer product by publishing it on social media.

Anyone who carries out his activity independently, i.e. without a dependent relationship with the employer, and works for his own account via the Internet.

What are the most common types of revenue generated by a content creator?

The first type:

- Revenues generated from making visual or audio content (such as making videos, audio clips, or video or audio broadcasts) on digital platforms or various mobile and computer applications such as YouTube, Tik Tok, Facebook, and Instagram.

The second type:

- Revenues generated from advertising and promoting goods or services within the content, in return for money or in return for obtaining the advertised goods or services (such as mobile phone reviewers, as some companies provide the reviewer with a mobile device to review and then obtain this device).

The third type:

- revenue resulting from the sale of products for the channel, which is known as Marche or Merchandise.

The fourth type:

- the revenue generated from the YouTube Fund for short videos.

The fifth type:

- revenue generated from collecting donations from followers through Ipatreon, YouTube, or similar sites and programs.

What is the net taxable income of the content industry?

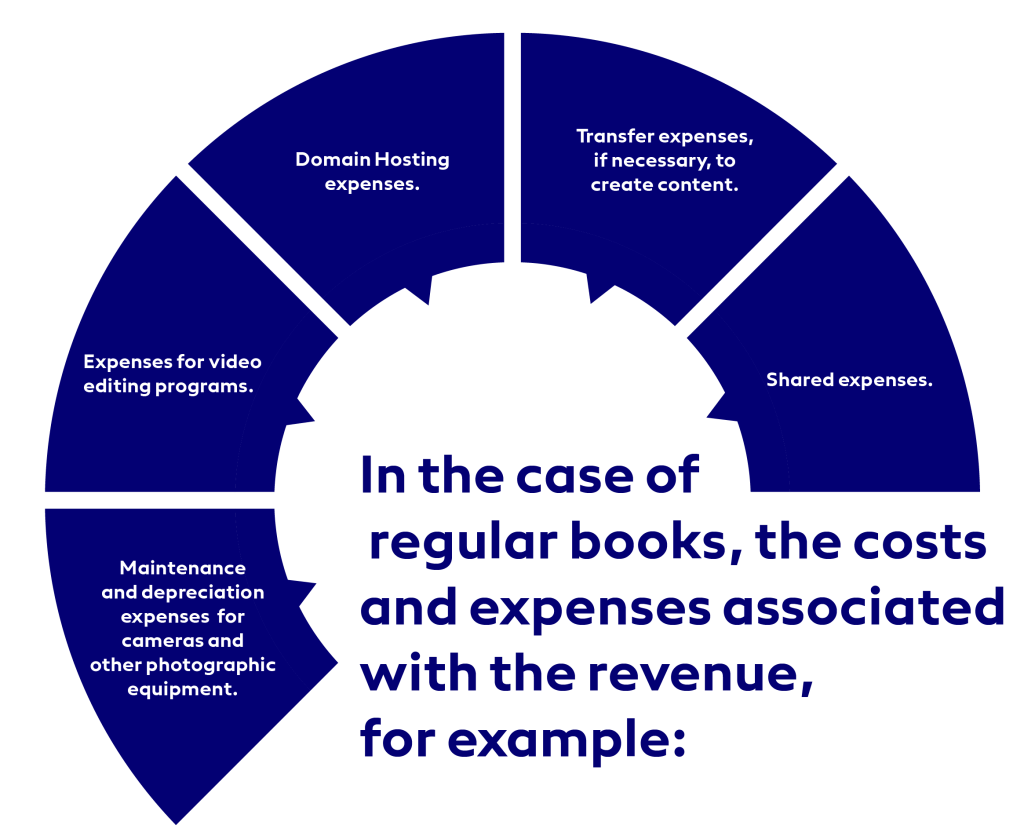

In the case of regular books, the costs and expenses associated with the revenue, for example:

- Maintenance and depreciation expenses for cameras and other photographic equipment.

- Expenses for video editing programs.

- Domain Hosting expenses.

- Transfer expenses, if necessary, to create content.

- Shared expenses.

In the absence of regular books, in the event that regular books are not kept, 10% of the total revenues will be deducted against all costs.

You can find more details on the ETA official website

Types of a Content Creator Taxations

Income taxations:

They are a direct taxatons imposed on the income of natural persons (individual establishment) or the profit of legal persons (companies) earned from practicing non-commercial professions, commercial or industrial activities, or providing services, in accordance with the provisions of the Income Tax Law promulgated by Law No. 91 of 2005 and its amendments.

Value Added Taxations:

It is an indirect tax imposed on all goods during the trading stages (buying and selling operations) or when providing services, except for goods and services that are exempt from tax, in accordance with the provisions of Value Added Tax Law No. 67 of 2016 and its amendments.

It is necessary to register for the income tax at the Egyptian Tax Authority as soon as you start practicing a commercial or professional activity, whether it is practiced traditionally or electronically. As for the registration in the value-added tax, there are conditions that must be met in order for the activity to be subject to the tax.

It is important for a content creator to consult with a qualified tax professional or accountant to ensure that they are in compliance with all applicable tax laws and regulations. Failing to pay the required taxations on content creation income can result in penalties, fines, and other legal consequences.