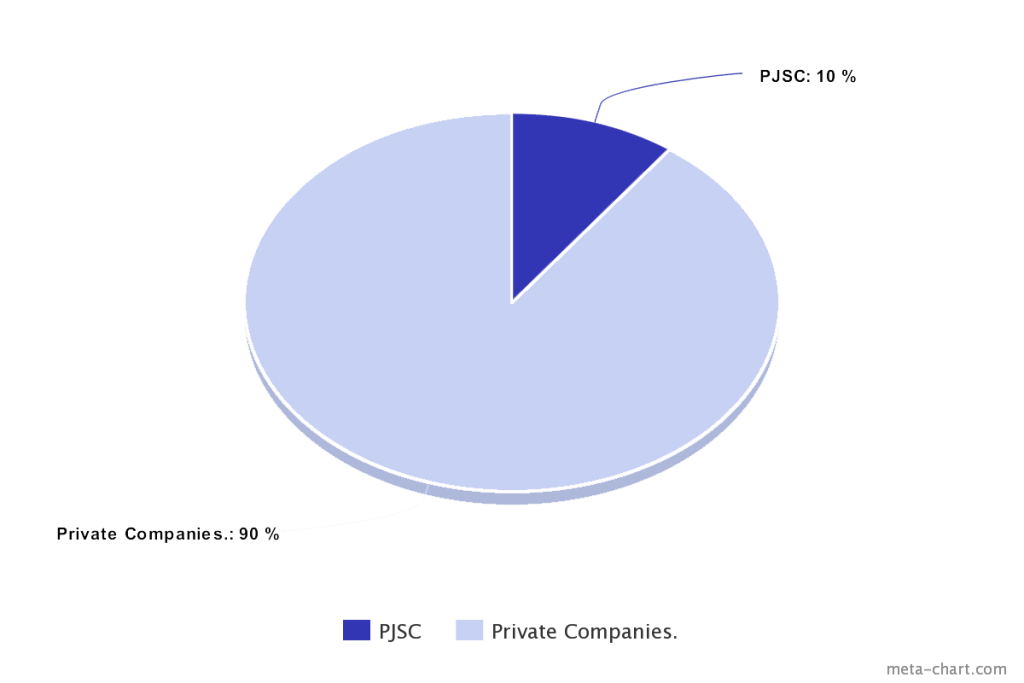

The Federal Tax Authority (FTA) announced a new development that would affect businesses across the country. Starting from May 15, 2023, corporate tax registration would be open for Public Joint Stock Companies (PJSCs) and Private Companies in the UAE. This move was part of the country’s efforts to diversify its revenue streams and enhance its economic competitiveness.

Table of Contents

Corporate Tax Registration for PJSCs and Private Companies

The FTA made it clear that corporate tax registration would be mandatory for all PJSCs and Private Companies in the UAE that met certain criteria. Companies that were already registered for Value Added Tax (VAT) would also be required to register for Corporate Tax. The registration process was expected to be completed online through the FTA’s website.

The Expected Revenue from Corporate Tax

The introduction of corporate tax in the UAE was expected to generate significant revenue for the government, with the FTA estimating that the revenue from corporate tax would reach AED 7 billion by 2025. This revenue would be used to fund various government initiatives and projects aimed at enhancing the country’s economic development.

What This Means for Businesses in the UAE

The introduction of corporate tax in the UAE was a significant development for businesses in the country. PJSCs and Private Companies would need to ensure that they met the criteria for mandatory registration and completed the registration process on time. The move towards corporate tax was part of the UAE’s efforts to align with international tax standards and enhance its economic competitiveness. Businesses in the UAE would need to factor in the impact of corporate tax on their financial planning and ensure that they were compliant with the regulations.

At present, the Corporate Tax registration process is only available to individual legal entities. Entities that wish to form a Corporate Tax Group must register individually first and then apply to form a Corporate Tax Group at a later date.

To register for Corporate Tax, visit the Corporate Tax registration portal available on the FTA website.

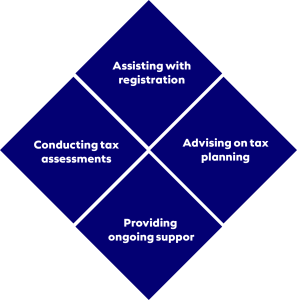

In what ways can AHG provide assistance with respect to the new law?

- Assisting with registration: We can assist our clients with the registration process for Corporate Tax. This includes helping clients obtain a Tax Registration Number and ensuring that all necessary information is submitted accurately and on time.

- Conducting tax assessments: for our clients to determine their tax liability under the Corporate Tax Law. This can help clients understand how much tax they need to pay and plan accordingly.

- Advising on tax planning: Advise our clients on tax planning strategies to reduce their tax liability under the Corporate Tax Law. This can include structuring transactions in a tax-efficient manner, taking advantage of available exemptions and deductions, and optimizing the timing of income and expenses.

- Providing ongoing support: provide ongoing support to our clients to ensure that they remain compliant with the Corporate Tax Law. This includes helping clients maintain accurate records, preparing tax returns, and representing clients in tax disputes or audits.

Overall, AHG’s expertise and support would be valuable to their clients as they navigated the complexities of the Corporate Tax Law and ensured compliance with the law.

AHG is a leading regional auditing and chartered accountancy firm, with presence in the GCC and North Africa. Since 2014, AHG has helped companies operating in the UAE achieve maximum success. We are fully prepared to assist your business in the United Arab Emirates with a team of trained tax experts to prepare your business for corporate tax in the United Arab Emirates.

The AHG-Dubai Group serves a wide range of clients and multinational corporations. This comes in light of the company’s strategy to focus on two main pillars: geographical expansion in frontier markets and driving a positive societal culture. By combining our strengths and expertise in the region, we provide our clients with best-in-class services tailored to their needs to maximize their investment goals in a rapidly changing environment.