Apply for the Tax Residency Certificate in UAE

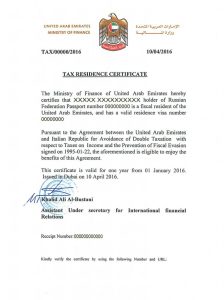

The UAE has earned a reputation as a business haven thanks to its tax-friendly policies that attract entrepreneurs from all corners of the world. While the tax system is relatively light, companies are still required to stay on the right side of the law by following all related rules. One key document that plays an important role in staying compliant is the Tax Residency Certificate. This certificate proves that a person or business is officially a tax resident in the UAE and helps avoid double taxation, especially when dealing with countries that have tax treaties with the UAE.

For businesses and individuals looking to benefit from these treaties and steer clear of unnecessary taxes, it’s essential to Apply for the Tax Residency Certificate in UAE. Doing so not only keeps you compliant but also opens the door to a more efficient financial structure. Whether you’re an expat professional or a multinational company, it’s in your best interest to Apply for the Tax Residency Certificate in UAE to stay ahead of the curve and operate smoothly within the UAE’s tax framework.

Steps to Apply for a Tax Residency Certificate in UAE

To Apply for the Tax Residency Certificate in UAE without hassle, it’s important to follow a clear set of steps. These points below explain how individuals or companies can apply properly:

- Check eligibility: First, make sure you meet the basic conditions. Individuals must live mainly in the UAE and have their main financial connections based there. For businesses, they are usually eligible if they are registered in the UAE or considered a tax resident under the country’s tax system. Always double-check if there are any other specific rules from the authority that must be met.

- Apply for the TRC: After confirming eligibility, create an account on the Federal Tax Authority (FTA) portal. Once your account is active, you can Apply for the Tax Residency Certificate in UAE by filling in the required online form.

- Gather and maintain documents: Make sure you have all the documents ready before submitting the application. These may include passport or Emirates ID copies, trade license, residence visa, tenancy contract, certified establishment contract (if applicable), and the last six months of bank statements. Required documents will differ depending on whether the applicant is an individual or a company.

- Submit the application and documents: Once everything is ready, upload the documents along with the completed application form on the FTA portal. Pay the necessary application fee and wait for the review. Typically, the certificate is issued within a week or so.

Following these steps carefully will make it easier to Apply for the Tax Residency Certificate in UAE and avoid any delays or rejections. Also, it’s essential to ensure that all submitted information is accurate, because any errors or missing data could lead to cancellation of the TRC. Once approved, the certificate helps prevent double taxation and proves that the applicant is a UAE tax resident.

How AHG Can Help You Apply for the Tax Residency Certificate in UAE

AHG’s experienced tax team is ready to give you a hand in applying for the Tax Residency Certificate in UAE. They’ll help you gather and organize all the necessary documents and make sure everything is in line with the latest rules to avoid any errors or delays. Their professionals will also guide you through the full application process step by step, so you can Apply for the Tax Residency Certificate in UAE smoothly and without complications. Whether you’re a business owner or an individual, AHG is always ready to offer support when needed, making the whole process faster and stress-free.

conclusion

In conclusion, securing the Tax Residency Certificate is essential for individuals and businesses looking to benefit from the UAE’s tax treaties and avoid double taxation. By ensuring that all documents are accurate and the procedures are properly followed, you can streamline the process and stay compliant with UAE tax laws. Apply for the Tax Residency Certificate in UAE with the guidance of a trusted expert to avoid delays and unnecessary complications. AHG’s professional team is always ready to assist you every step of the way, making it easier than ever to Apply for the Tax Residency Certificate in UAE with confidence.

Managing finances as an influencer in the UAE can get complicated, but AHG makes it easier. With our experience in influencer accounting, we handle everything from tax compliance to financial planning, so If you need any tax services or tax consultancy, you won’t find better than AHG Legal Accounts. Each of our teams has extensive experience in this field and will provide you with the best services in a professional manner. Please feel free to contact us today, we are always waiting for your request to be fulfilled!

Click Here