tax residency certificate in UAE 2025

A tax residency certificate is an official document issued by a country’s government to confirm that an individual or business is considered a resident for tax purposes. This certificate plays a key role in proving residency status when calculating taxes, especially in cases involving multiple countries.

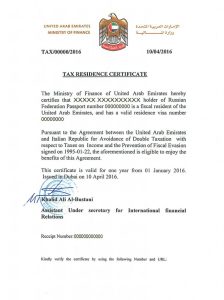

In the UAE, obtaining a tax residency certificate is particularly important due to the Double Taxation Avoidance Agreements signed with numerous countries. These agreements help individuals and businesses avoid being taxed twice on the same income. The tax residency certificate in UAE 2025 is essential for those looking to benefit from these agreements, ensuring compliance with tax regulations while optimizing financial planning.

Who can apply for a tax residency certificate in UAE

In the UAE, only residents are eligible to apply for a tax residency certificate. To qualify, an individual must have lived in the country for at least 180 days. This requirement ensures that only those with a substantial presence in the UAE can benefit from the tax residency certificate in UAE 2025, which is crucial for tax planning and avoiding double taxation under international agreements.

Advantages of Tax Residency Certificate in UAE

A tax residency certificate obtained in the UAE is valid for one year from the date of issuance. This certificate comes with several perks, mainly helping individuals avoid double taxation under international agreements. It serves as official proof of residency for tax purposes, allowing individuals to minimize income tax where applicable legally.

Financial institutions, including banks, often rely on this certificate to determine tax deduction requirements based on residency status. The tax residency certificate in UAE 2025 is a valuable tool for tax planning and compliance.

Validity of Tax Residency Certificate in UAE

A tax residency certificate issued in the UAE remains valid for one year from the date it is issued.

Procedures for obtaining a tax residency certificate in UAE

To apply for a tax residency certificate (TRC) in the UAE, follow these steps:

- Access the EMARATAX portal and start your application.

- Use your existing EMARATAX account, create a new one, or link an old account from the previous TRC portal.

- Once logged in, go to “Other Services.”

- Select the Tax Registration Number (TRN) if applicable. If no TRN is available, choose the “No TRN” option, which allows the automatic filling of details based on the TRN.

- Choose the type of certificate you need.

- Complete the application, pay the submission fees, and submit it for processing.

- After receiving approval from the Federal Tax Authority (FTA), pay the certificate processing fees.

- If a special tax form requires FTA attestation for treaty purposes:

- Attach an electronic form to the TRC portal; it will be returned with the required signature.

- Send the form by mail with a return service.

- Use a courier service with a return option.

- The applicant is responsible for all document handling fees.

- Ensure the tax form matches the application details, including the financial year of the certificate.

required documents to apply for a tax residency certificate in UAE

To apply for a tax residency certificate in the UAE as an individual, you need to provide the following documents:

- A copy of your Emirates ID and passport.

- A valid residence permit.

- Bank statements from the past six months.

- A salary or income certificate.

- A copy of your tenancy contract.

- A statement from the General Directorate of Residency and Foreigners Affairs confirming your stay in the UAE.

- Any additional documents requested by the authorities.

Ensuring that all documents are accurate and complete helps prevent delays or rejection of your application by the Ministry of Finance. Staying informed about the latest tax regulations is also essential for effective tax planning.

How AHG Can Help You Get Tax Residency Certification in UAE

Navigating the registration process for tax certificates or refunds can be tricky, especially with the various tax rules affecting business transactions. If you’re feeling overwhelmed, AHG can provide expert guidance to help you understand tax implications and streamline your tax, accounting, compliance, and reporting processes.

AHG’s dedicated tax consultants are well-versed in regional tax regulations and can assist with documentation, ensuring you meet all requirements efficiently. They also offer valuable insights into best tax practices to keep your business on track. If you need assistance with obtaining a tax residency certificate in UAE 2025, AHG is ready to offer fast and reliable support.

Conclusion

Securing a tax residency certificate in UAE 2025 is essential for individuals and businesses looking to benefit from tax treaties and avoid double taxation. Understanding the process, meeting the requirements, and ensuring proper documentation are key to a smooth application. With expert guidance from AHG, you can navigate tax regulations with ease and stay compliant. Whether you need assistance with tax residency certification or broader tax planning, AHG is here to support you every step of the way.

Managing finances as an influencer in the UAE can get complicated, but AHG makes it easier. With our experience in influencer accounting, we handle everything from tax compliance to financial planning, so If you need any tax services or tax consultancy, you won’t find better than AHG Legal Accounts. Each of our teams has extensive experience in this field and will provide you with the best services in a professional manner. Please feel free to contact us today, we are always waiting for your request to be fulfilled!

Click Here